When you invest in a Delaware Statutory Trust (DST), it’s important to understand what you are buying, the real estate, sponsor, or both. Knowing and understanding your DST sponsor’s track record will help you choose the best 1031 exchange investment property for your needs and budget. Our team at Diversified Investment Strategies is here to help!

With DSTs, properties are identified and purchased by a sponsor, then offered to investors through investment representatives and advisors. Each investment has a built-in margin for the sponsor. As the investor, a percentage of your investment is immediately used to pay the sponsor, once the deal is done. This helps cover the cost of not just the sponsor’s time finding, selecting and purchasing the property, but also the hands-off management, potentially higher cash flow, potential additional depreciation and appreciation, and other potential benefits provided by investing in a DST. The key is understanding how long it will take you to recapture this cost, based on the projected rate of return.

The use of 1031 exchanges among real estate investors has led to an increase in sponsors entering the market to meet the demand. It’s more important than ever to understand exactly what you’re getting with a DST investment, and with the property’s sponsor.

Here are some questions to consider:

1. Does the sponsor have a proven track record of success? Many sponsors are just jumping into the 1031 exchange market. Make sure you find sponsors that already have experience with DSTs.

2. Does the sponsor have knowledge and experience in the asset class and market which the real estate is located? The price of a DST will have much to do with location, history, age of the property, tenants and more. Sponsors need to have deep knowledge in all of these areas.

3. How much did the sponsor pay for the property, and is this in par with other properties in the market? Sponsors may overpay for a property because they are obligated to make new products available for investors.

4. Pay attention to the sponsor’s fees. Are disposition fees and expenses capped? How do the prices compare to other sponsors? They may be making up for overpaying for a property with their fees.

5. How well does the master lease align the interests of you, the investor, and the sponsor? The closer they’re aligned, the better. Are there any conflicts of interest?

6. Are there any unexplained markups on a property that a sponsor just recently purchased? Unless a sponsor has put significant value into the property, an appraisal may not justify the markup.

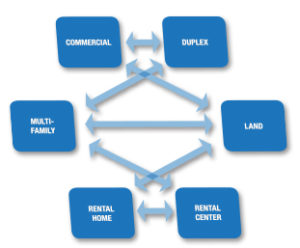

These are just some of the questions to consider when choosing a DST property, and when paying attention to the sponsor of that property. Our team at DIS can help you determine the best DST investment options for you, based on your needs and the current market! Give us a call and we’ll be happy to guide you through the 1031 exchange process when investing in a DST or in any other 1031 exchange options.

Bryan Hakola

Diversified Investment Strategies

Visit Our Website

Learn About Your Investment Options

Become Our Facebook Fan

Follow Us on Twitter

Connect on Linked