Are you a real estate investor tired of toilets, trash and tenants? Are you instead dreaming of time, travel and teeing off? It might be time to switch gears and exchange your real estate investment properties.

If you own highly appreciated real estate assets, we understand that you don’t want to let go of them, nor do you want to pay taxes on them. At Diversified Investment Strategies, our comprehensive team is here to help you through a 1031 exchange!

A 1031 exchange will allow you to trade investment properties in a way that will postpone paying capital gains taxes. You’ve got lots of options! One option we want to fill you in on today is a Delaware Statutory Trust, or DST. When properly structured, this would allow you to sell an investment asset, defer the taxation on the sale, and buy a DST replacement property on a tax-deferred basis.

As a DST investor, you own a portion of the trust as the DST Beneficiary. While there will be multiple DST owners, each with their own percentage of the trust, the DST Beneficiary receives the economic benefits of the property. By pooling money with other investors, you can invest in assets that a typical investor could not afford.

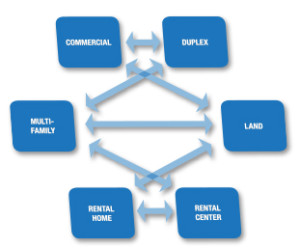

Examples of DST real estate include office buildings, shopping centers, apartment buildings, industrial properties, warehouses and more. The options are endless, and diversification is one of the many perks of a Delaware Statutory Trust.

If you want to retire and have more time for travel, family, etc., then the best perk is that you will no longer be in charge of property management! This will free up your time and allow you to rest, physically and mentally.

Other benefits include:

- Higher monthly ‘tax-sheltered’ cash flow potential than from original property

- Potential for greater capital investment appreciation on present equity

- Short Holding period on property ownership

- No closing costs

- Close escrow in 3-5 days

- Minimum investment as low as $100,000

There are numerous other perks to a DST 1031 exchange, but there are risks you should know about as well. You can read about the perks and the risks on our website.

If you have questions about a DST, or other options available in a 1031 exchange, contact our comprehensive team! At DIS, we specialize in real estate investment exchanges that will benefit the investor and delay capital gains taxes. Backed by years of experience and expertise, we can ensure that your next investment is motivated by an informed decision, and we can talk you through the entire process.

Don’t make a rash decision! Contact us to talk about your options.

Bryan Hakola

Diversified Investment Strategies

Visit Our Website

Learn About Your Investment Options

Become Our Facebook Fan

Follow Us on Twitter

Connect on LinkedIn