Now more than ever, real estate investors are evaluating their real estate investments and choosing to exchange into investments that make the most sense per their finances, the present market, and their future needs. Our team at Diversified Investment Strategies is here to help. Contact us at anytime to discuss your real estate investments, and to discuss what steps make the most sense for you, and if a 1031 exchange makes sense for you at this time.

Now more than ever, real estate investors are evaluating their real estate investments and choosing to exchange into investments that make the most sense per their finances, the present market, and their future needs. Our team at Diversified Investment Strategies is here to help. Contact us at anytime to discuss your real estate investments, and to discuss what steps make the most sense for you, and if a 1031 exchange makes sense for you at this time.

It’s important to note that the election is coming up, and that 1031 exchanges may be on the chopping block, according to various reports. Presidential candidate Joe Biden’s latest proposal calls for phasing out the 1031 exchange program for investors making over $400,000 annually. With this in mind, it may make sense for you to make your 1031 exchanges sooner than later, with the future of them uncertain at this time. More information can be found in this Bloomberg article.

So, with this in mind, how can you successfully complete a 1031 exchange without having to pay out of pocket for a higher priced investment, or have to pay “boot,” federal taxes on a property if the replacement property costs less than the relinquished property? We know how important financial security is to you right now!

The rule is as follows: A 1031 exchange property must be of even or greater value. However, this isn’t the whole story. Investors have to keep transaction fees in mind. So, more accurately, your replacement property has to be equal to or greater than the value of your exchange funds. Exchange funds include equity, debt and profits earned from the sale of the relinquished property.

For example, if you sell a property for $550,000, say you pay $30,000 in transaction fees. You have $225,000 in equity and $275,000 in remaining debt. You net about $20,000 in profits. That leaves roughly $520,000 in exchange funds. However, if you anticipate $20,000 in acquisition fees, you should look for property in the range of $500,000 for an even trade.

Of course, our team at DIS is here and ready to discuss all of this with you, and to help you find the best investment properties for an even 1031 exchange. One great 1031 exchange option is a Delaware Statutory Trust, or DST. DSTs have many benefits, but one in this particular case is that they do not require additional acquisition fees. Therefore, the total of your exchange funds may be used in a transaction to purchase interest in a DST.

If you have questions about any of this, or you would like assistance on completing a 1031 exchange this fall, contact our team at DIS! We can answer any questions you may have, and help you get started on the process.

Bryan Hakola

Diversified Investment Strategies

Visit Our Website

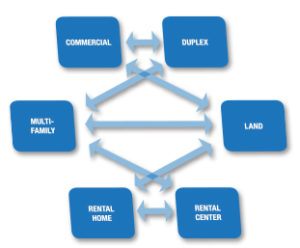

Learn About Your Investment Options

Become Our Facebook Fan

Follow Us on Twitter

Connect on Linked