If this bill were to pass, as it is currently written, like-kind exchanges would be limited to only real estate, but a transition rule would take place, allowing completion of currently pending 1031 exchanges of personal property. Here at DIS, we only work with real property 1031 exchanges.

H.R. 1 retains section 1031 for real property, which excludes the exchange of commercial real estate from immediate taxing when certain rules are followed. This will allow commercial real estate to continue playing its important role in our country’s economy. Real estate investors may continue forward with confidence in investing in commercial real estate, which can strengthen the economy, grow local communities, increase job production and allow property to be used for its highest and best use.

The Tax Cuts and Jobs Act must still be voted on in the Senate before being signed into law by President Trump, but as it stands now, 1031 exchanges will continue to allow taxpayers to defer taxes when exchanging investment property with like-kind property.

At DIS, our comprehensive team of tax advisors, attorneys, real estate brokers and financial consultants provide solid information and analysis backed by years of experience and knowledge. We would love to help guide you through the 1031 exchange process if you and your properties qualify!

Once your specific needs are determined, and all pertinent information has been obtained, our team will help you find and acquire a replacement property suitable to your needs!

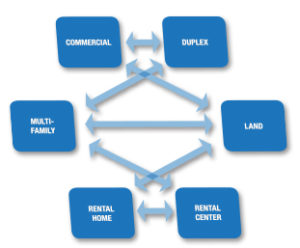

When it comes to 1031 exchanges, there are numerous investment options, and we can help you determine which would best fit your needs. We work with Delaware Statutory Trusts, which are increasing in popularity, UP-REITS, Triple-Nets, Oil & Gas, Saltwater Disposal Wells and Direct Purchases. More details on each of these options is available on our website here.

If you are new to the 1031 exchange process, our team at DIS will fill you in on everything you need to know. Certain rules must be followed, such as timelines, like-kind guidelines and qualified intermediaries, who possess the money during the exchange process. We can fill you in on all of this!

Now that your mind can rest a little easier, knowing that 1031 exchanges have been unchanged in the new proposed tax bill for real property, give us a call, and let’s see what type of exchanges we can help you with as real estate investors!

The information herein has been prepared for educational purposes only and does not constitute an offer to purchase or sell securitized real estate investments. DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million dollars exclusive of primary residence) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity please verify with your CPA and Attorney. There are risks associated with investing in real estate properties including, but not limited to, loss of entire investment principal, declining market values, tenant vacancies and illiquidity. Because investors’ situations and objectives vary, this information is not intended to indicate suitability for any particular investor. Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated. Diversification does not guarantee profits or guarantee protection against losses. This material is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Securities offered through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Diversified Investment Strategies is independent of CIS.

Bryan Hakola

Diversified Investment Strategies

Visit Our Website

Learn About Your Investment Options

Become Our Facebook Fan

Follow Us on Twitter

Connect on Linked