If you’re a real estate investor, you may have heard of a 1031 exchange, but still need some clarification on how it works. Diversified Investment Strategies is here to help! Our comprehensive team of tax advisors, attorneys, real estate brokers and FINRA registered financial consultants will provide you solid information and analysis, backed by years of experience and expertise!

To help you understand how a 1031 exchange works, and who can use it, here are five facts you should know:

- A 1031 exchange isn’t for personal use. This tax provision is for investment and business property only and cannot be used to swap your primary residence for another home. We can fill you in on the narrow loophole in which you can use a 1031 for a vacation home, but otherwise, it is just for swapping investment properties or business properties.

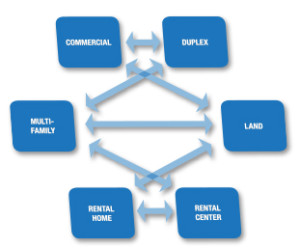

- The property exchange must be with a “like-kind” property. While this is true, it’s also very broad. That is why you can exchange an apartment for land, or a ranch for a strip mall, as examples. You can also exchange one business for another. But there are rules to when and how this applies. This is why working with our team of professionals at DIS is so beneficial!

- You need a qualified intermediary. It’s very unlikely that you’ll find the exact property you want, and that owner will want your property, and you’ll both be ready to swap at the same time. Therefore, a qualified intermediary will handle the exchange. As the seller, you cannot touch the money in between the sale of the old property and the purchase of the new property. At Diversified Investment Strategies, we can help you find a qualified exchange partner!

- You must designate replacement property within 45 days. Once the sale of your property is finished, the intermediary will receive the cash. You will have 45 days from the sale of your property to designate replacement property in writing to the intermediary. At DIS, we can help you find desired replacement property and help you specify the property you want to acquire to the intermediary, in writing.

- You must close within six months. You must close on the new property within 180 days after selling your initial property. The two timetables run together, so if you designate replacement property exactly 45 days after your closing, you’ll have 135 days left to close on the replacement property. Your 180 begins when you close on your initial property, not from the day you identify your new property.

These are just some of the facts that you should know about 1031 exchanges. They can seem complicated, but when you’re working with a professional team of experts, like you will find here at DIS, we can take a lot of the stress and confusion out of the process. When you’re ready to begin the process, or you have questions, please contact us!

Bryan Hakola

Diversified Investment Strategies

Visit Our Website

Learn About Your Investment Options

Become Our Facebook Fan

Follow Us on Twitter

Connect on LinkedIn