Our team here at Diversified Investment Strategies is continually filling you in on how 1031 exchanges may be able to help real estate investors. From building wealth and delaying taxes, to trading up to properties that may yield a better return, there are many potential benefits to 1031 exchanges.

This time, instead of us telling you about the benefits, take the word of U.S. News & World Report. They recently shared a report on how 1031 exchanges could help real estate investors build wealth. As they said, a 1031 exchange is “a continuity of investment liquidity.” If you don’t sell and cash out, you aren’t liquidating. You’re just trading one investment for another.

Aside from avoiding the need to pay federal taxes on your investment property sale, here are some of the other potential benefits of a 1031 exchange:

-You’ll have more money to invest with by deferring federal income taxes, which may then lead to a greater earning potential.

-Exchanges such as a DST, 721 UPREIT or Triple Net NNN offer investors the chance to reap property ownership rewards without landlord duties and management hassles.

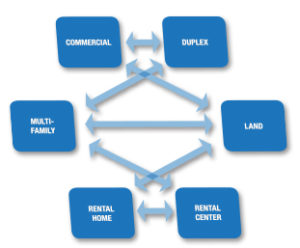

-One property may be exchanged for many properties, and different types of properties as well, so there is the potential for diversification.

-You may experience greater pricing flexibility and the possibility to trade up to larger and higher quality properties.

Check out more of the potential benefits of a 1031 exchange.

Of course, before using a 1031 exchange, there are some rules to consider. U.S. News & World Report broke down some of the biggest ones:

1. The exchange must be of like-kind. In a 1031 exchange, you must sell your investment property for a like-kind property. Therefore, you cannot buy a property that you plan on flipping or living in, and you can’t trade for stocks, collectibles or other types of investments.

2. You need to use a qualified intermediary. A QI will handle the transaction’s paperwork and reporting requirements and will hold onto the funds from the sale until an exchange takes place. The investor cannot have hold of the funds at any time during the process.

3. Deadlines must be met. Once you sell your investment property, you have 45 days to identify up to three properties you’d like to purchase with your funds, in writing. The value of these properties must equal or be greater than the property sold. You have 135 days to close on the property.

This is a basic rundown of how a 1031 exchange works, and how it can help you build wealth as a real estate investor. If you have questions or would like to learn more, contact our team at DIS! We are a team that specializes in helping investors choose a plan that makes the most sense for their situation. All you have to do is call and we’d be more than happy to walk you through the process and help you plan for your future!

Bryan Hakola

Diversified Investment Strategies

Visit Our Website

Learn About Your Investment Options

Become Our Facebook Fan

Follow Us on Twitter

Connect on Linked