If after a lot of research and reading through our website, you decide you want to dive into the 1031 exchange pool, you’ll need to know what’s next? Like all structured real estate deals and investments there are few hoops to jump through, t’s to cross and i’s to dot. But don’t fear – we’re here to help you every step of the way. One of the components of a 1031 exchange is identifying your like-kind property to exchange also known as the replacement property. According to the rules of 1031 exchange, there are very specific criteria that must be followed through this identification process. We have broken them down below.

What is a like-kind property exactly?

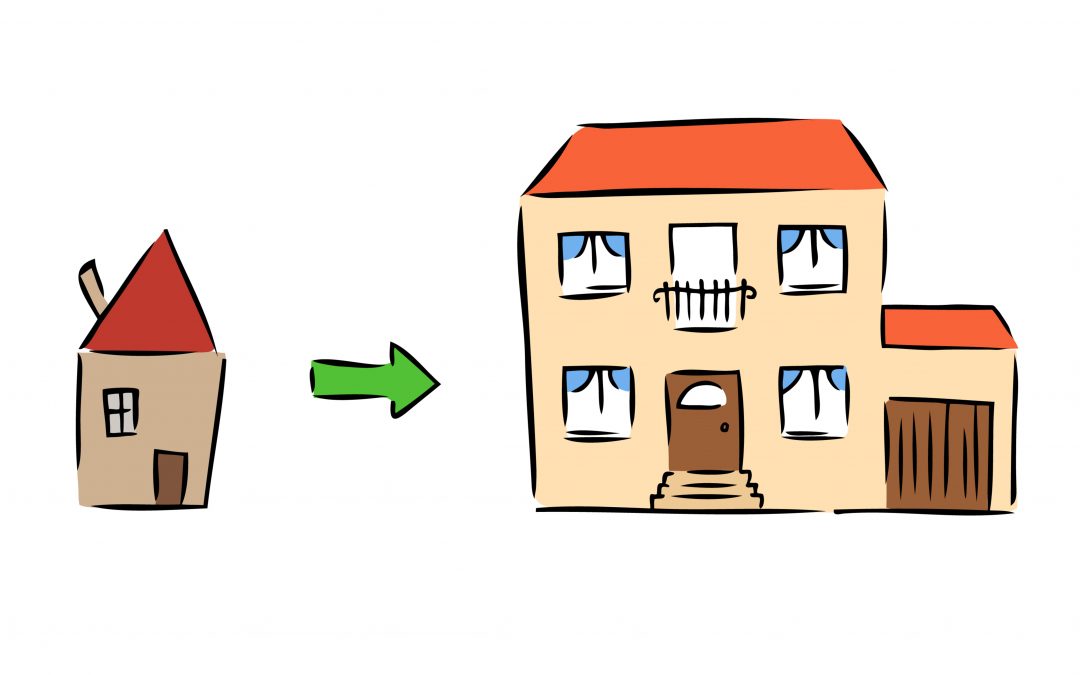

Like-kind property is real property held for investment or the productive use in a trade or business to be exchanged on a tax-deferred basis for other real property. An investor can exchange from a single-family residence to industrial, land or multifamily. Commercial office can be exchanged for multifamily, single family to DST, etc. As long as it is real property, it is like-kind.

Identify Your Replacement Property

Now that you know what you’re looking for, you have a 45-day identification window to identify the next property – meaning you as the exchanger must identify a replacement property within 45 days of sale from you relinquished or sold property. And you can’t just select any property. There are three rules used to specify this replacement property:

The Three Property Rule

This rule was developed in 1991. Prior to that, an exchanger could only name one property. If they wanted to identify a second one, the first one had to fall through. Today, the exchanger can name three replacement properties of any individual or combined value. One or more of the three named properties can then be purchased as qualifying replacement property.

The 200% Rule

You can name as many properties as desired if the total value of all properties does not exceed 200% of the sale price of first property.

The 95% Rule

You can name as many properties as desired regardless of total value (even exceeding the 200% rule described above), as long as you ultimately buy, as their replacement property, at least 95% of the total value of all properties named under this method.

What if you change your mind?

It’s important to note, property identifications can be revoked, but only if done so within the initial identification period.

Where to Identify Properties

On our website we have a current and running list of properties to peruse. Register for free to view a comprehensive list of available properties for your 1031 exchange.

For more information about either of these investment opportunities, contact us for more detailed information. Visit our website for other types of exchanges that are set up as tax-deferring investment strategies including DSTs, UPREITS and more.

Diversified Investment Strategies represents a team of experienced and trusted professionals specializing in real estate investment and services – including buying, selling, leasing, retirement planning and wealth growth and management through strategic, informed investment choices and a meticulous real estate investment analysis. As knowledgeable replacement property professionals, they help clients build a customized strategy that identifies suitable investments pursuing successful completion of a 1031 Tax-Deferred Exchange. Visit them at www.diversified1031.com or call 866-261-0104.

There are material risks associated with investing in DST properties and real estate securities including liquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short term leases associated with multi-family properties, financing risks, potential adverse tax consequences, general economic risks, development risks, long hold periods, and potential loss of the entire investment principal. Past performance is not a guarantee of future results. Potential cash flow, returns and appreciation are not guaranteed. IRC Section 1031 is a complex tax concept; consult your legal or tax professional regarding the specifics of your particular situation. This is not a solicitation or an offer to sell any securities. DST 1031 properties are only available to accredited investors (typically have a $1 million net worth excluding primary residence or $200,000 income individually/$300,000 jointly of the last three years) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity please verify with your CPA and Attorney.

Diversified 1031 does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

Securities offered through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Diversified 1031 is independent of CIS.