If you are concerned about your real estate investments during these uncertain times, now is your opportunity to consider more diversification in your investments. When you sell an investment property, you can perform a 1031 exchange so that you can purchase one or more like-kind properties to replace the sold property and avoid paying federal taxes. When you exchange the property, consider diversifying into other types of properties.

Our definition of diversification is this: An investment strategy of allocating proceeds across a variety of assets or products to build a portfolio of investments across unrelated markets, so a downturn in one particular market may not drastically affect the returns of the entire portfolio.

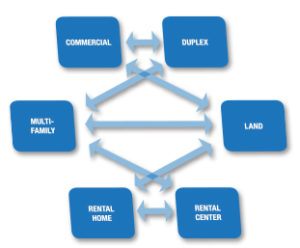

Exchanged property must be like-kind, but this just means it has to be real property. An investor can exchange from a single-family residence to a DST, industrial, land or multifamily. A commercial office can be exchanged to multifamily, oil and gas, etc. Lots of diversification is possible.

For example, if you sell a multifamily investment property in San Diego, you could replace with a single-family residence in Miami, a triple net credit lease property in Atlanta and a portion of a medical building in Houston. Diversifying real estate investment property is like diversifying your stock portfolio. Financial advisors tend to recommend both.

So, what are your potential options? Aside from outright purchasing one investment property, such as a single-family residence, here are some ways to diversify more:

Delaware Statutory Trust (DST) – Allows an investor to invest as a fractional owner. You invest in institutional grade real estate, receiving potential benefits of real estate ownership without landlord responsibilities. This allows investors to spread their equity among multiple sponsors, such as geographic location, leases, tenants, asset classes, property types and more.

UPREIT (721 Exchange) – Allows investors potentially greater liquidity and/or exit options of their real estate holdings. You can own interest in a diversified real estate portfolio of institutional quality properties that are professionally managed. REITs generally have properties located in many geographic locations, as well as have tenant, industry and sometimes asset class diversification.

With both a DST and UPREIT, diversification allows for a variation of asset classes, which may increase the security of your investments. If one asset class doesn’t do well, you have the others to fall back on. Similarly, you can diversify into different markets, so that if the market isn’t doing well in one location, you have the others to rely on. A DST or UPREIT may also come in handy when estate planning. If you inherit one large property and disagree with the other inheritors of what to do with it, you can exchange it into different, smaller properties for each individual, or become fractional owners through a DST or UPREIT.

Tenants in Common (TIC) – Shared ownership of property where each owner owns a share of the property. Shares can be unequal in size and can be transferred freely to other owners.

Triple Net (NNN) – This structure seeks to provide consistent income with minimal management obligations, class “A” tenants and little, if any, labor requirements.

Opportunity Zones – Community development program to encourage long-term investments in low-income urban and rural communities. Rewards those who invest in these Opportunity Zones.

Oil and Gas Royalties – Mineral owners own interest in sub-surface real estate and are entitled to compensation potential for everything produced from their land.

To learn more about potential diversification options in a 1031 exchange, check out our website. For help deciding how you should diversify, and what first steps you should take in your 1031 exchange, contact our team here at Diversified Investment Strategies! We are here to help you make suitable decisions for your financial future.

The information herein has been prepared for educational purposes only and does not constitute an offer to purchase securitized real estate investments. DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million dollars exclusive of primary residence) and accredited entities only. Such offers are only made through the sponsors Private Placement Memorandum (PPM) which is solely available to accredited investors and accredited entities. There are material risks associated with investing in DST properties and real estate securities including liquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short term leases associated with multi-family properties, financing risks, potential adverse tax consequences, general economic risks, development risks, long hold periods, and potential loss of the entire investment principal. Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated. This material is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Because investors situations and objectives vary this information is not intended to indicate suitability for any particular investor. IRC Section 1031, IRC Section 1033 and IRC Section 721 are complex tax concepts, therefore you should consult your legal or tax professional regarding the specifics of your particular situation. Investors should read the PPM carefully before investing paying special attention to the risk section. Securities offered through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Diversified 1031 is independent of CIS.

Bryan Hakola

Diversified Investment Strategies

Visit Our Website

Learn About Your Investment Options

Become Our Facebook Fan

Follow Us on Twitter

Connect on Linked