For a 1031 exchange to work, certain guidelines must be followed. Inform yourself with these guidelines and you’re on your way to a 1031 exchange:

1. Have the proper entities to be exchanged. Many taxpaying entities may qualify for a 1031 exchange, such as individuals, C corporations, S corporations, partnerships, LLCs and trusts. 1031 exchanges most often occur with the sale of real estate investment property, where the property you purchase is like-kind with the property you sell. Under certain rules, vacation property may be exchanged. What cannot be exchanged is inventory or stock in trade, stocks, bonds or notes, partnership interests, or certificates of trust.

2. Have a Qualified Intermediary ready. With a 1031 exchange, you cannot handle the money exchange yourself. You must hire a Qualified Intermediary. This person holds onto the profits from the sale and then disburses them at the closing of the exchanged property. You may not at any time have your hands on that money. If there is money left over from the sale, after the exchange, this cash is taxable income. A QI is an independent party with the sole purpose of facilitating the exchange process.

3. Have a like-kind property or properties to exchange. Like-kind property is actually more diverse than you may think. Quality or grade of property doesn’t matter. Most real estate is like-kind to other real estate, however, there are exceptions. For example, property in the U.S. must be exchanged with property in the U.S., and investment property cannot be exchanged for personal property. But you can exchange one property for multiple properties, apartments for commercial business property, etc. To qualify as like-kind, the total purchase price of the replacement property must be equal or greater than the sales price of the relinquished property, and all equity form the relinquished property must be used to acquire the replacement property.

4. Have your timelines in order. Following the 1031 exchange timelines is crucial. If these are not met, the 1031 exchange may fall through. First, you must identify potential replacement properties within 45 days of selling your relinquished property, and the identification must be in writing and given to those involved in the exchange, such as the seller or QI. Then, the 1031 exchange must be completed within 180 days from the sale of the relinquished property.

If these rules are followed, you may be on your way to completing a 1031 exchange! The most important first step to take is to find a team of professionals that can answer your questions and guide you through the entire 1031 exchange process, so you don’t miss a single step. Our team at DIS is here to do that. Give us a call when ready to begin!

Bryan Hakola

Diversified Investment Strategies

Visit Our Website

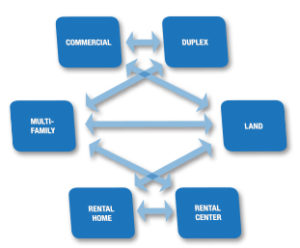

Learn About Your Investment Options

Become Our Facebook Fan

Follow Us on Twitter

Connect on Linked

This is for informational purposes only and does not constitute an offer to purchase or sell securitized real estate investments. There are risks

associated with investing in real estate and Delaware Statutory Trust (DST) properties including, but not limited to, loss of entire investment

principal, declining market values, tenant vacancies and illiquidity. Potential cash flows/returns/appreciation are not guaranteed and could be

lower than anticipated. Diversification does not guarantee profits or guarantee protection against losses. Because investors situations and

objectives vary this information is not intended to indicate suitability for any particular investor. This material is not to be interpreted as tax or

legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation. Securities offered

through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Diversified Investment Strategies is independent of CIS.